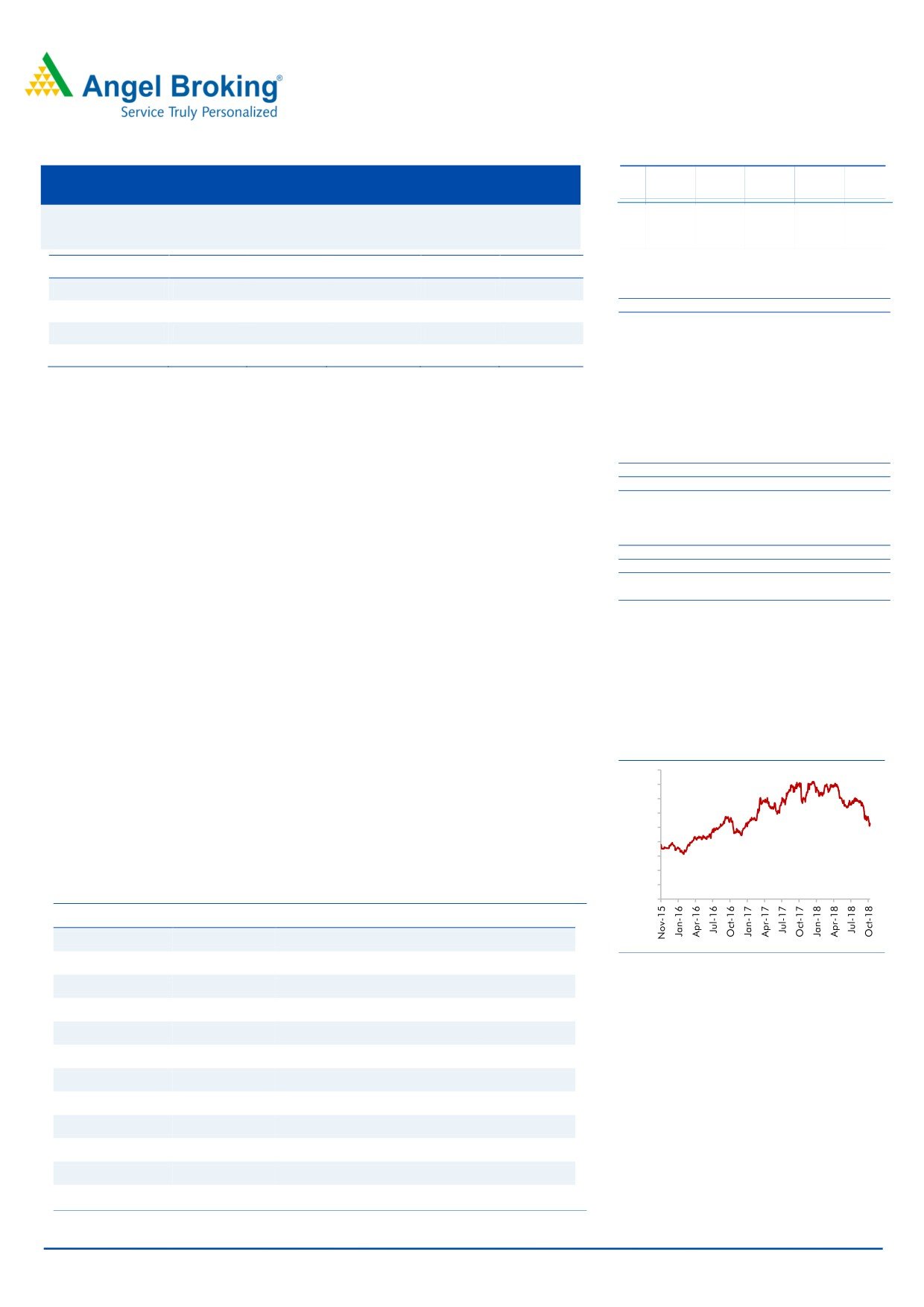

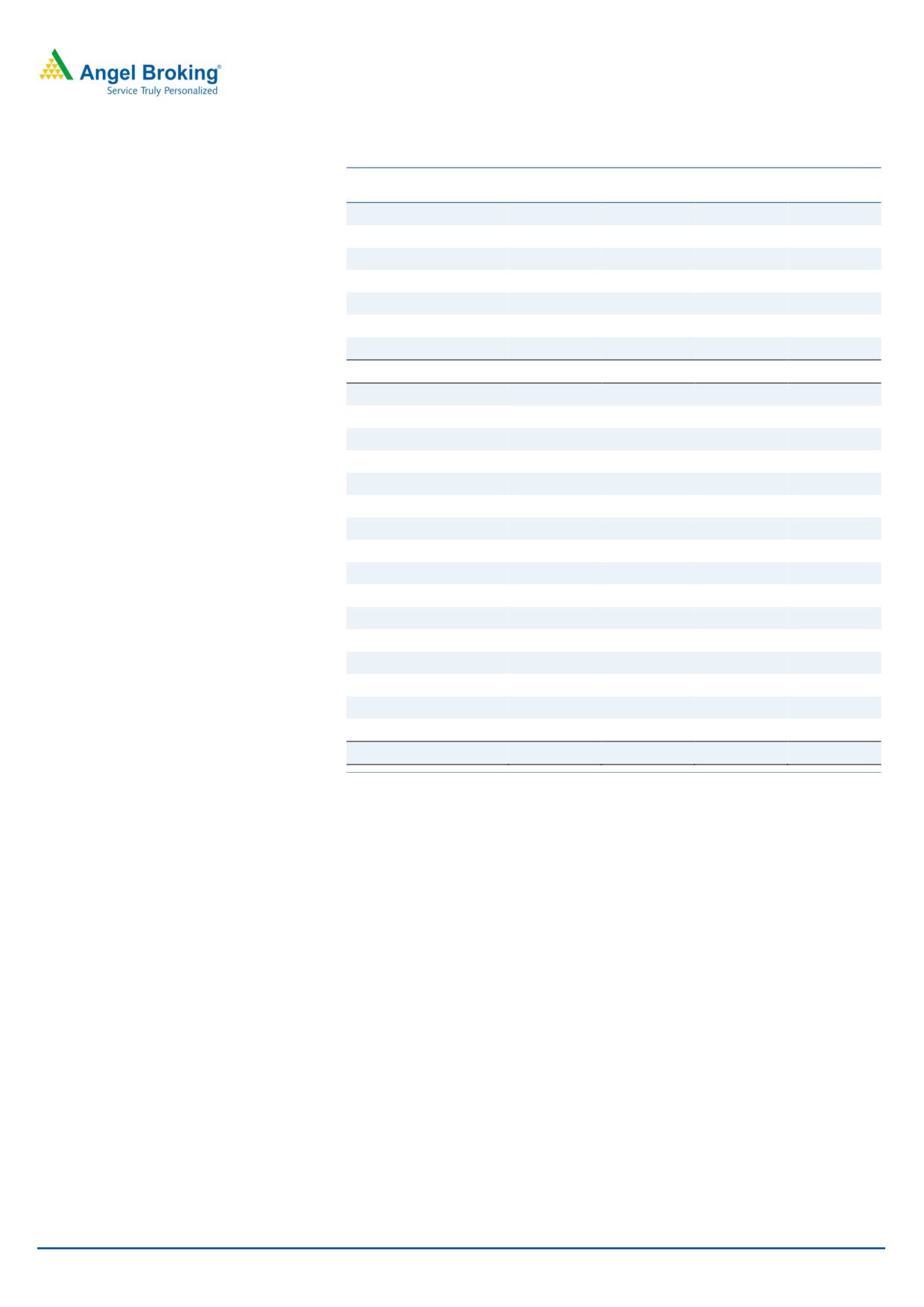

2QFY2019 Result Update | Cons. Durable

November 3, 2018

Blue Star Ltd

BUY

CMP

`565

Performance Update

Target Price

`867

2QFY19

2QFY18

% chg. (yoy)

1QFY19

% chg. (qoq)

Investment Period

12 Months

Net Sales

1,032

850

21.5

1,508

(31.5)

Stock Info

Operating profit

58

49

18.7

137

(57.5)

Sector

Cons. Durable

OPM (%)

5.6

5.8

(13bp)

9.1

(344bp)

Market Cap (` cr)

5,490

Net Debt (` cr)

210

Adj. PAT

20

23

(14.0)

91.6

(78.7)

Beta

0.2

Source: Company, Angel Research

52 Week High / Low

845/507

Avg. Daily Volume

11,670

Face Value (`)

2

For 2QFY2019, Blue Star posted results above our expectations on the top-line front;

BSE Sensex

34,314

however, bottom-line numbers came below expectations. The company has reported 21.5%

Nifty

10,351

Reuters Code

BLUS.BO

top-line growth, whereas PAT was down ~14% yoy due to losses in JV and higher interest

Bloomberg Code

BLSTR IN

cost.

Shareholding Pattern (%)

Promoters

38.7

Strong revenue growth Electro-Mechanical Project (EMP) and better than industry

MF / Banks / Indian Fls

20.9

performance boosted top-line: The company’s top-line grew 21.5% yoy at `1,032cr on the

FII / NRIs / OCBs

8.3

Indian Public / Others

32.1

back of strong performance in EMP Business (up ~27% yoy) driven by accelerated

Abs.(%)

3m

1yr

3yr

execution of major MEP projects. Further, Professional Electronics and Industrial Systems

Sensex

(8.4)

3.7

29.7

business revenues increased by ~55% yoy. However, Unitary Products business revenues

Blue Star

(16.9)

29.3

48.7

increased marginally by 9% yoy. Room AC business has performed better than the industry

and the market share has improved (current market share at 12.3%).

PAT de-grew ~14%: On the operating front, the company’s margins contracted by 13bps

yoy on the back of higher raw material prices. The bottom-line, posted de-growth of ~14%

yoy to `20cr on account of higher interest cost, one time exceptional expense (`2.7cr) and

losses in International JV.

3-year price chart

Outlook & Valuation: We forecast Blue Star to report top-line CAGR of ~13% to `5,854cr

900

over FY2018-20E on the back of healthy demand growth in Air Conditioning and Unitary

800

700

Products division. On the bottom-line front, we estimate ~18% CAGR to `201cr owing to

600

500

improvement in volumes and better operating margins. We maintain our Buy

400

recommendation on Blue Star with a target price of `867.

300

200

100

Key Financials

0

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

Net Sales

4,385

4,648

5,122

5,854

Source: Company, Angel Research

% chg

13.5

6.0

10.2

14.3

Net Profit

123

144

154

201

% chg

12.2

17.0

6.9

30.5

OPM (%)

5.1

5.7

6.1

6.3

EPS (Rs)

12.8

15.0

16.0

20.9

P/E (x)

44.1

37.7

35.2

27.0

Amarjeet S Maurya

P/BV (x)

7.2

6.7

6.2

5.7

022-39357800 Ext: 6831

RoE (%)

16.3

17.7

17.6

21.0

RoCE (%)

16.5

17.0

19.2

21.7

EV/Sales (x)

1.2

1.2

1.1

1.0

EV/EBITDA (x)

24.6

21.2

17.9

15.1

Source: Company, Angel Research Note: CMP as of October 31, 2018

Please refer to important disclosures at the end of this report

1

Blue Star Ltd | 2QFY2019 Result Update

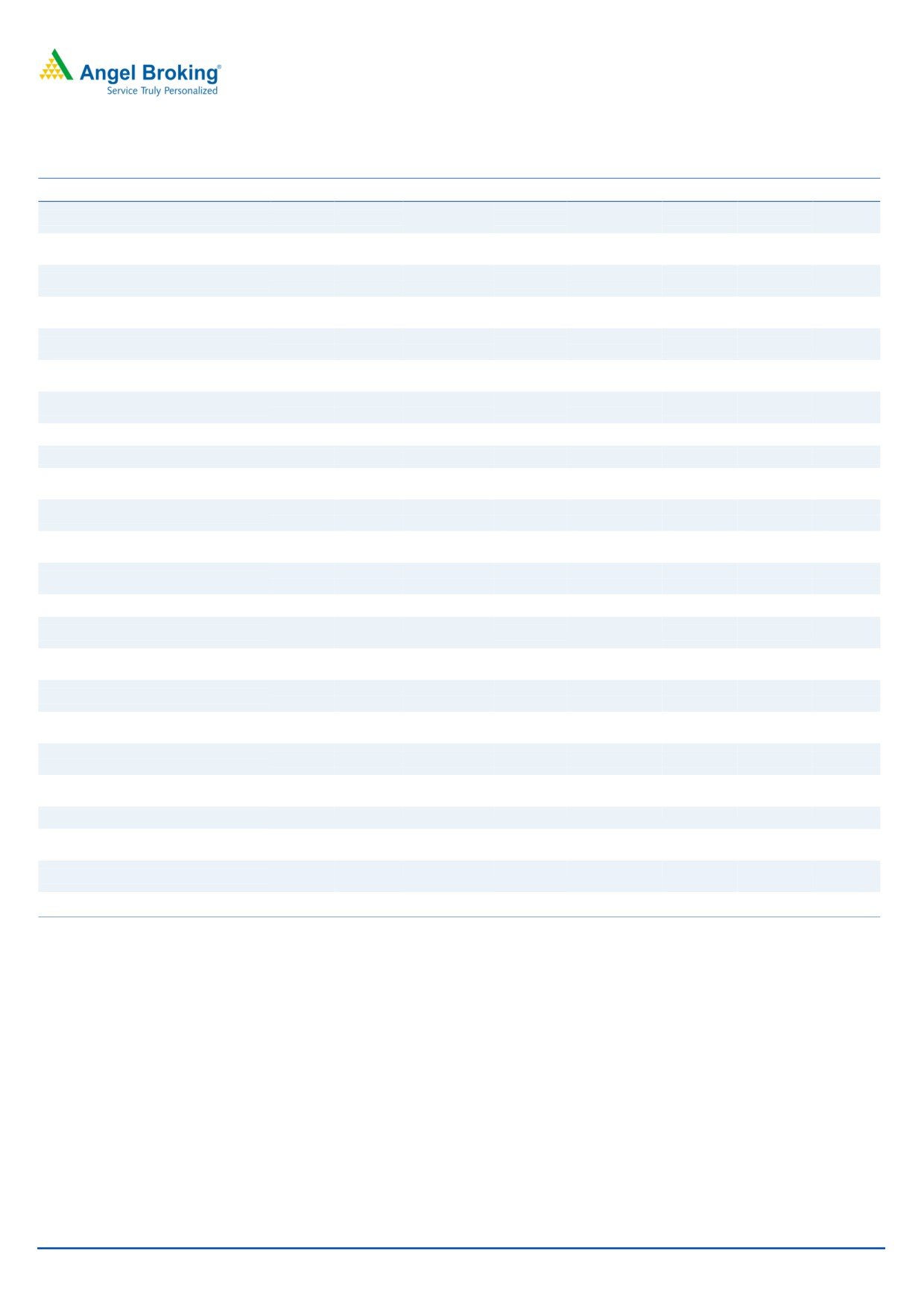

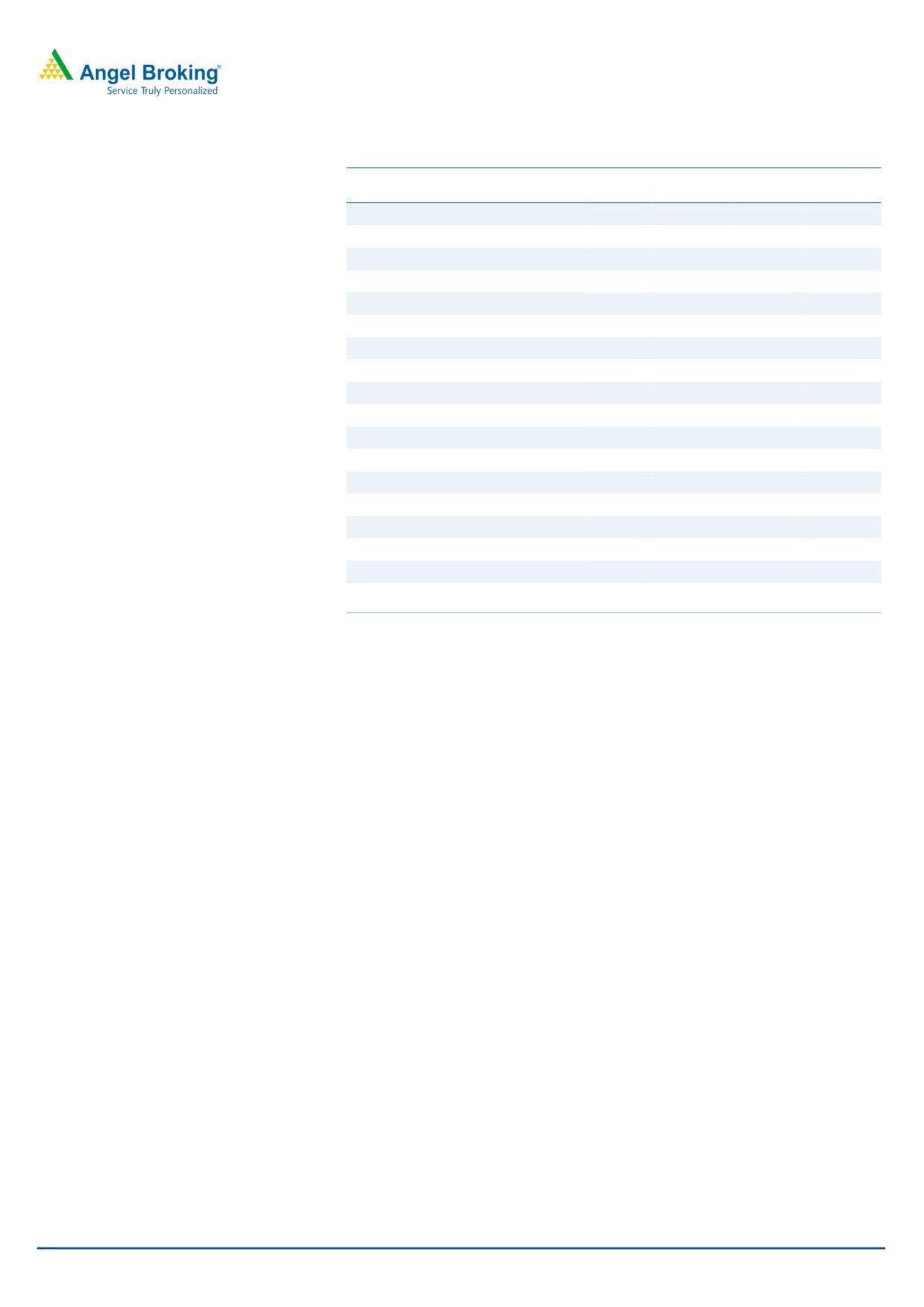

Exhibit 1: 2QFY2019 Performance

Y/E March (` cr)

2QFY19

2QFY18

% chg. (yoy)

1QFY19

% chg. (qoq)

1HFY19

1HFY18

% chg

Net Sales

1,032

850

1,508

2,540

2,370

21.5

(31.5)

7.2

Net raw material

704.7

1071.9

1772.5

1664.7

559

26.0

(34.3)

6.5

(% of Sales)

71.1

69.8

70.2

68.3

65.8

244

(282)

Employee Cost

106

100

5.7

100

5.9

206

189

9.1

(% of Sales)

6.6

8.1

8.0

10.3

11.8

(153)

363

Other Expenses

164

141

15.8

199

(17.9)

367

357

2.8

(% of Sales)

13.2

14.5

15.1

15.8

16.6

(78)

263

Total Expenditure

974

801

21.6

1,371

(29.0)

2,345

2,210

6.1

Operating Profit

58

49

18.7

137

(57.5)

195

160

22

OPM (%)

9.1

7.67

6.73

5.6

5.8

(13)

(344)

93

Interest

12

6

98.8

12

(3.6)

24

11

122.6

Depreciation

17

16

7.2

16

5.2

33

28

16.5

Other Income

5

5

9.3

3

47.6

8

13

(37.0)

PBT

34

32

8.2

112

(69.2)

146

134

9.4

(% of Sales)

7.4

5.8

5.6

3.3

3.7

Exceptional Items

(2.7)

15.2

12.5

Tax

8

9

(17.3)

33

(75.9)

40

35

14.1

(% of PBT)

29.1

27.6

26.4

22.8

29.8

Reported PAT before MI & Extra Ord.

24

22

6.9

95

(74.8)

118

98

20.4

Items

PATM

6.3

4.7

4.1

2.3

2.6

Minority Interest

P/L of Ass. Co.

(4)

1

(2.9)

(7)

1

Extra-ordinary Items

(0)

(0)

(0.1)

(0)

(0)

Reported PAT

20

23

(14.0)

92

(78.7)

111

99

12.4

Source: Company, Angel Research

November 3, 2018

2

Blue Star Ltd | 2QFY2019 Result Update

Key investment arguments

Cooling Products division - the backbone of growth: Company is estimating +20%

growth (outperform the market at 15-20% growth) in FY19E in the cooling

products division. Further, owing to the strong growth in this summer, the market is

expected to be further driven by the rise in demand.

Newer products and strong demand to aid overall profitability: Blue Star is

planning to add two brand new models to its RAC product range in FY19, it has

four models currently. The company is planning to launch one high wall-cordless

split AC model around the same time. Besides that, increase in demand from large

government related infra projects like metro and some small segments from

hospitals and educational institutions will also boost sales.

Wide distribution network: Blue Star has a strong presence in the South and West

regions of India and is now planning to increase its presence in North. Hence,

company has already increased its dealer count and is taking steps to improve per

dealer output in Northern region. Moreover, Bluster Silicones, an overseas

subsidiary of China National Bluster (Group) signed a distribution agreement with

Grasim Industries in India for its whole series of silicone products in an attempt to

expand its distribution network in India and increase its market share.

November 3, 2018

3

Blue Star Ltd | 2QFY2019 Result Update

Outlook & Valuation:

We forecast Blue Star to report top-line CAGR of ~13% to `5,854cr over FY2018-20E on

the back of healthy demand growth in Air Conditioning and Unitary Products division. On

the bottom-line front, we estimate ~18% CAGR to `201cr owing to improvement in volumes

and better operating margins. We maintain our Buy recommendation on Blue Star with a

target price of `867.

Downside risks to our estimates

Any slowdown in consumer segments like IT/ITES, healthcare, hospitality and

infrastructure could impact the company’s growth.

Foreign exchange fluctuations have a direct impact on the profit of the cooling

products division since commercial refrigerators are imported.

The RAC industry has been witnessing high traction and the company has

been able to outperform the industry over the past few years. Any unexpected

drop in performance of the RAC industry would pose a threat to our estimates.

Company Background

Blue Star Limited is an air-conditioning and commercial refrigeration company.

The company conducts various activities, such as electrical, plumbing and fire-

fighting services. Its segments include Electro-Mechanical Projects and Packaged

Air Conditioning Systems, and Unitary Products. The Electro-Mechanical Projects

and Packaged Air-Conditioning Systems segment includes central air-conditioning

projects, electrical contracting business and packaged air-conditioning businesses,

including manufacturing and after sales service. The Unitary Products segment

includes cooling appliances, cold storage products, including manufacturing and

after sales service. The company's products include central air conditioning, room

air conditioners and speciality cooling products. Its other businesses include

marketing and maintenance of imported professional electronic equipment and

services, as well as industrial products and systems, which is handled by Blue Star

Engineering & Electronics.

November 3, 2018

4

Blue Star Ltd | 2QFY2019 Result Update

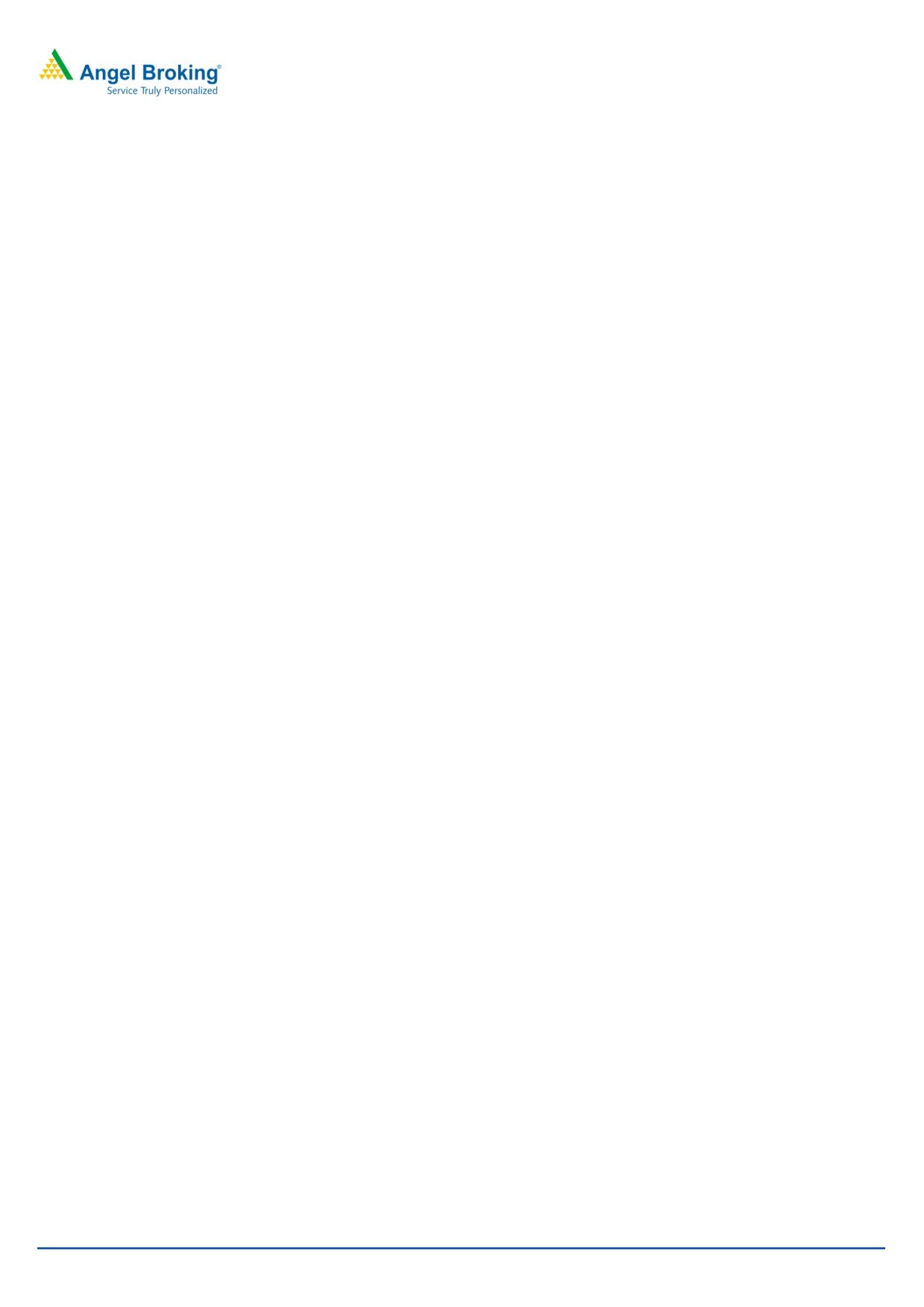

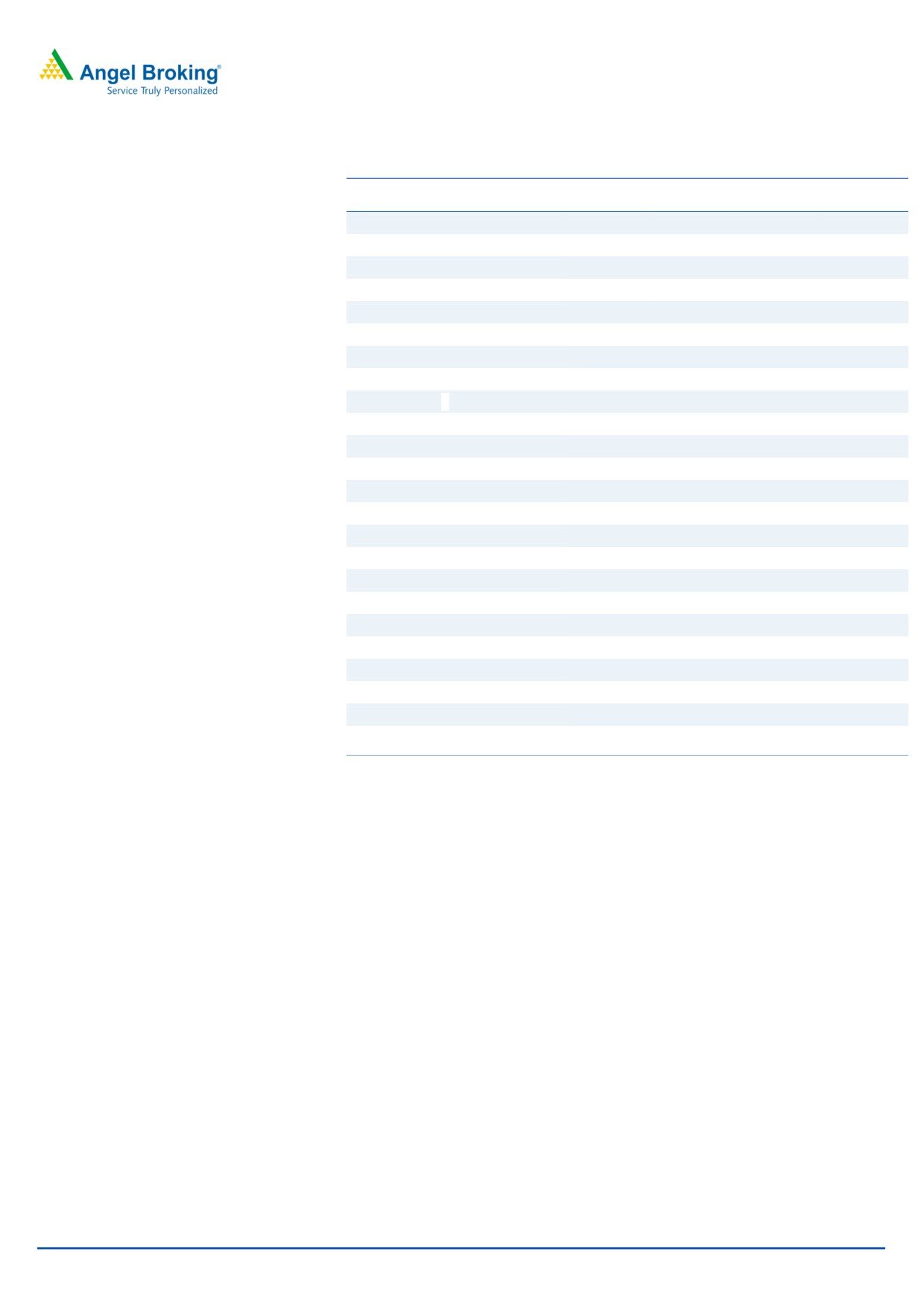

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

Total operating income

4,385

4,648

5,122

5,854

% chg

13.5

6.0

10.2

14.3

Total Expenditure

4,163

4,382

4,810

5,485

Raw Material

3,112

3,229

3,488

3,981

Personnel

339

398

441

515

Others Expenses

712

756

881

989

EBITDA

222

266

312

369

% chg

39.0

19.6

17.5

18.0

(% of Net Sales)

5.1

5.7

6.1

6.3

Depreciation& Amortisation

61

64

71

78

EBIT

162

202

242

291

% chg

57.2

24.9

19.5

20.3

(% of Net Sales)

3.7

4.3

4.7

5.0

Interest & other Charges

38

29

41

32

Other Income

35

17

20

20

(% of PBT)

21.8

8.9

9.1

7.2

Share in profit of Associates

-

-

-

-

Recurring PBT

159

190

221

278

% chg

19.7

20.0

16.1

26.1

Tax

37

49

60

75

(% of PBT)

23.1

26.0

27.0

27.0

PAT (reported)

122

141

161

203

Minority Interest (after tax)

0

0

0

0

Profit/Loss of Associate Company

1

2

7

2

Extraordinary Items

-

5

-

-

ADJ. PAT

123

144

154

201

% chg

12.2

17.0

6.9

30.5

(% of Net Sales)

2.8

3.1

3.0

3.4

Basic EPS (`)

12.8

15.0

16.0

20.9

Fully Diluted EPS (`)

12.8

15.0

16.0

20.9

% chg

12.2

17.0

6.9

30.5

November 3, 2018

5

Blue Star Ltd | 2QFY2019 Result Update

Consolidated Balance Sheet

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

SOURCES OF FUNDS

Equity Share Capital

19

19

19

19

Reserves& Surplus

738

796

857

938

Shareholders Funds

757

815

876

957

Minority Interest

1

1

1

1

Total Loans

221

371

380

380

Deferred Tax Liability

24

24

24

24

Total Liabilities

1,004

1,202

1,281

1,364

APPLICATION OF FUNDS

Gross Block

359

399

439

479

Less: Acc. Depreciation

72

135

206

284

Net Block

288

264

233

195

Capital Work-in-Progress

34

34

34

34

Investments

79

79

79

79

Current Assets

2,141

2,425

2,685

3,032

Inventories

596

815

912

1,042

Sundry Debtors

939

1,019

1,123

1,283

Cash

97

81

128

139

Loans & Advances

390

394

410

457

Other Assets

120

116

113

111

Current liabilities

1,670

1,732

1,882

2,108

Net Current Assets

471

693

803

924

Deferred Tax Asset

132

132

132

132

Mis. Exp. not written off

-

-

-

-

Total Assets

1,004

1,202

1,281

1,364

November 3, 2018

6

Blue Star Ltd | 2QFY2019 Result Update

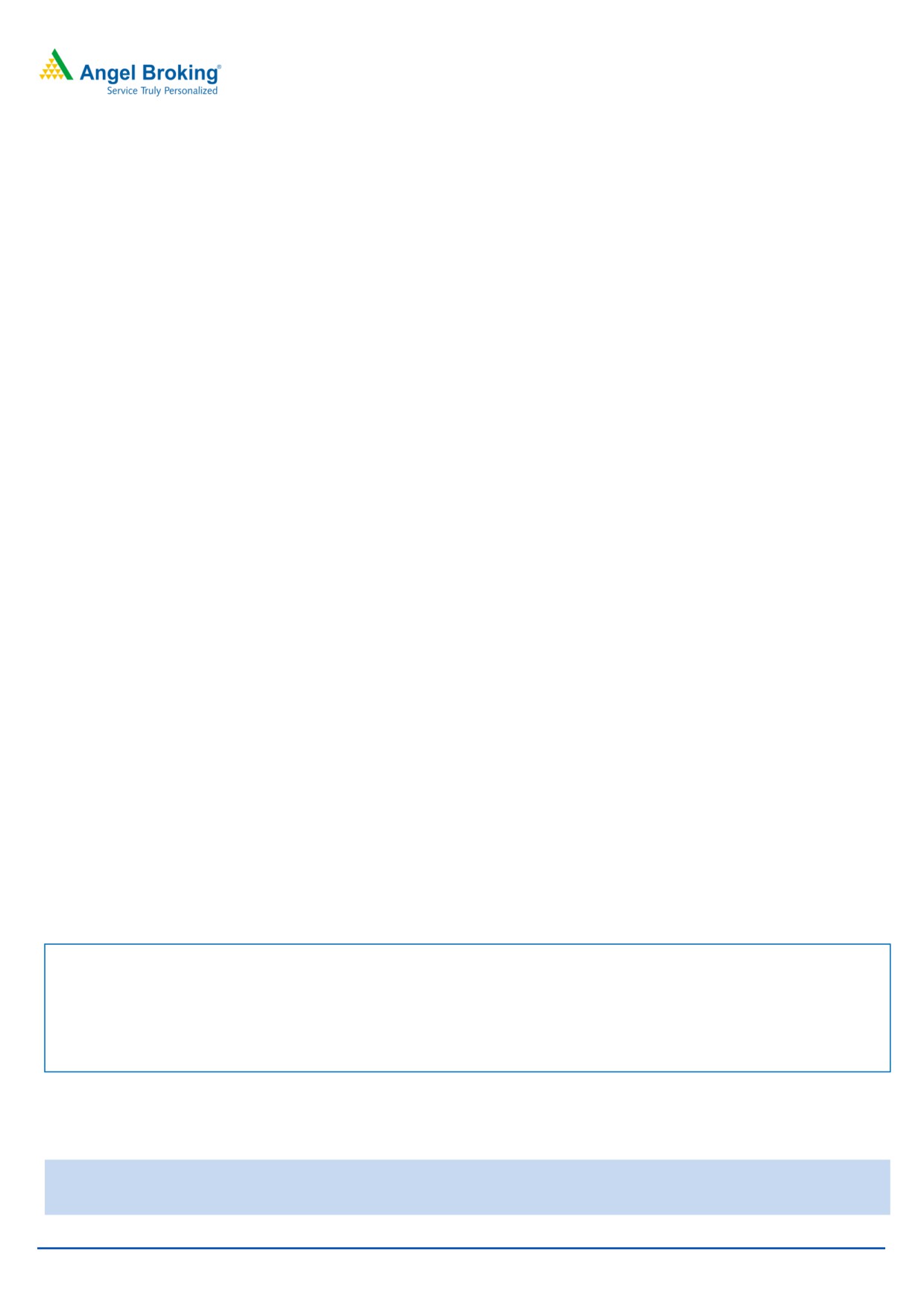

Consolidated Cash flow Statement

Y/E March (`cr)

FY2017

FY2018

FY2019E FY2020E

Profit before tax

159

190

221

278

Depreciation

61

64

71

78

Change in Working Capital

(105)

(238)

(63)

(110)

Interest / Dividend (Net)

19

29

41

32

Direct taxes paid

2

(49)

(60)

(75)

Others

(26)

0

0

0

Cash Flow from Operations

159

(4)

210

204

(Inc.)/ Dec. in Fixed Assets

(107)

(40)

(40)

(40)

(Inc.)/ Dec. in Investments

177

0

0

0

Cash Flow from Investing

69

(40)

(40)

(40)

Issue of Equity

7

0

0

0

Inc./(Dec.) in loans

6

150

9

0

Dividend Paid (Incl. Tax)

(2)

(86)

(92)

(121)

Interest / Dividend (Net)

(185)

(7)

(40)

(32)

Cash Flow from Financing

(174)

57

(123)

(152)

Inc./(Dec.) in Cash

54

12

47

11

Opening Cash balances

15

68

81

128

Closing Cash balances

68

81

128

139

November 3, 2018

7

Blue Star Ltd | 2QFY2019 Result Update

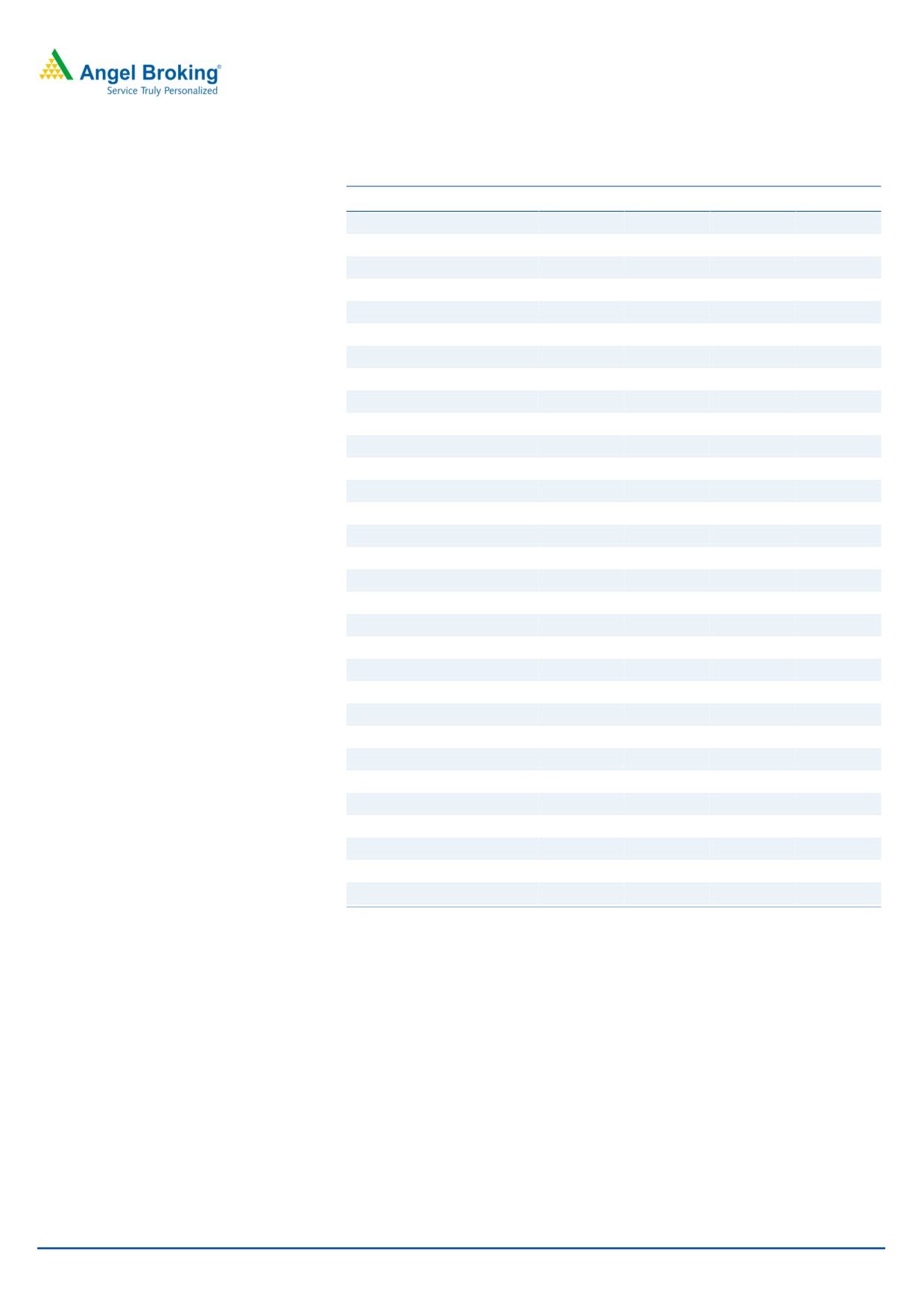

Key Ratios

Y/E March

FY2017

FY2018

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

44.1

37.7

35.2

27.0

P/CEPS

29.7

26.5

23.4

19.3

P/BV

7.2

6.7

6.2

5.7

Dividend yield (%)

1.3

1.6

1.7

2.2

EV/Sales

1.2

1.2

1.1

1.0

EV/EBITDA

24.6

21.2

17.9

15.1

EV / Total Assets

5.4

4.7

4.4

4.1

Per Share Data (`)

EPS (Basic)

12.8

15.0

16.0

20.9

EPS (fully diluted)

12.8

15.0

16.0

20.9

Cash EPS

19.0

21.3

24.2

29.3

DPS

7.5

9.0

9.6

12.6

Book Value

78.9

84.9

91.3

99.7

Returns (%)

ROCE

16.5

17.0

19.2

21.7

Angel ROIC (Pre-tax)

20.2

19.7

23.0

26.0

ROE

16.3

17.7

17.6

21.0

Turnover ratios (x)

Asset Turnover (Gross Block)

12.2

11.6

11.7

12.2

Inventory / Sales (days)

50

64

65

65

Receivables (days)

78

80

80

80

Payables (days)

98

95

93

90

Working capital cycle (ex-cash) (days)

30

49

52

55

Source: Company, Angel Research

November 3, 2018

8

Blue Star Ltd | 2QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Blue Star

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

November 3, 2018

9